In the pursuit of financial security, putting all your resources in one place can be a risky gamble.

Diversification offers a smarter path to protect and grow your wealth over time.

By strategically spreading investments across various asset classes, you build a resilient portfolio that withstands market storms.

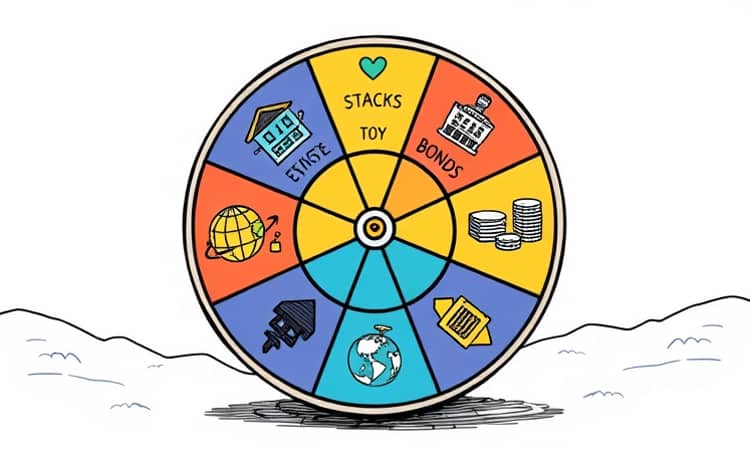

This article explores the Wealth Wheel metaphor, a guide to balancing your investments for long-term success.

Not putting all eggs in one basket is the core principle here, ensuring your financial future remains stable.

Embrace this approach to navigate economic cycles with confidence and clarity.

The Power of Diversification: Beyond Basic Investing

Diversification involves allocating your money to different types of investments to reduce overall risk.

It helps smooth out returns, making your wealth journey less turbulent and more predictable.

Historical events, like the 2022 market downturn, show that relying solely on stocks and bonds can backfire.

Broader diversification beyond traditional assets is essential for true financial resilience.

This strategy mitigates the impact of any single investment's poor performance.

Think of it as building a safety net for your hard-earned money.

Traditional Assets: The Hub of Your Wealth Wheel

Traditional assets form the central core of your investment portfolio, providing a foundation.

They include stocks, bonds, and cash equivalents, each with distinct roles and benefits.

- Stocks offer growth potential and historically outperform other assets over long periods.

- Bonds provide stability and income, acting as a hedge during market declines.

- Cash equivalents like T-bills ensure liquidity but yield lower returns.

However, these assets do not always move in opposite directions.

In 2022, both stocks and bonds fell simultaneously, highlighting their limitations.

High long-term returns from stocks come with volatility that needs balancing.

Diversifying within this hub by sector, size, and geography enhances stability.

Beyond the Hub: Adding Spokes with Non-Traditional Assets

To truly reduce risk, incorporate non-traditional assets that behave differently from stocks and bonds.

These assets lower correlation, meaning they don't always rise and fall together.

- Real estate provides appreciation and rental income, with tax benefits like 1031 exchanges.

- International equities hedge against domestic economic stagnation and inflation.

- Alternatives such as commodities respond uniquely to market shifts, offering protection.

Real estate offers appreciation and rental income, making it a valuable addition.

Access these through REITs, global funds, or direct ownership for flexibility.

This expansion creates a more robust and adaptable wealth strategy.

Visualizing Your Portfolio: The Wealth Wheel Table

Understanding how each asset class fits into your Wealth Wheel can simplify decision-making.

The table below summarizes key roles, benefits, and examples to guide your allocation.

Use this as a reference to balance your investments effectively.

International equities hedge domestic stagnation, adding a layer of security.

The Tangible Benefits of a Diversified Approach

A diversified portfolio delivers smoother returns and reduces the emotional stress of investing.

It limits the damage from market crashes and enhances long-term growth potential.

- Risk reduction through lower portfolio volatility and fewer extreme losses.

- Historical evidence shows diversified accounts recover faster from downturns.

- Psychological ease from knowing your wealth is spread across multiple avenues.

Diversified portfolios show smoother returns, making financial goals more achievable.

Studies indicate that adding assets like real estate can improve overall performance.

This approach also manages inequality by preventing over-concentration in winners.

Practical Steps to Build and Maintain Your Wealth Wheel

Implementing diversification requires careful planning and ongoing adjustment.

Start by assessing your risk tolerance, time horizon, and financial goals.

- Tailor asset allocation to your personal circumstances, such as age or income needs.

- Use vehicles like ETFs and mutual funds for low-cost, broad exposure.

- Rebalance regularly to maintain your target mix, especially after market shifts.

Tailor to risk tolerance and goals for a personalized strategy.

For specific groups, such as retirees, focus on capital preservation and steady cash flow.

Business owners can diversify post-sale liquidity events to secure their future.

Regular rebalancing to maintain targets keeps your Wealth Wheel spinning smoothly.

Navigating Challenges and Staying the Course

Diversification is not without its hurdles, but awareness can help you overcome them.

Common challenges include over-concentration in familiar assets and unfamiliarity with international markets.

- Avoid short-term speculation by focusing on long-term, enduring financial objectives.

- Understand correlation nuances: assets with less than perfect correlation add stability.

- Weather volatility with patience, as diversification pays off over extended periods.

Avoid short-term speculation to align with your wealth-building journey.

Data-driven allocation counters hesitations, such as fears about global investments.

Remember, the Kelly Criterion suggests limiting stock holdings to optimize risk.

Weather volatility for enduring goals is key to sustained success.

Inspiring Your Financial Future

Building your Wealth Wheel is a proactive step toward financial independence and peace of mind.

It transforms investing from a gamble into a structured, resilient plan.

By embracing both traditional and non-traditional assets, you create a portfolio that adapts to change.

Manage stress and economic edge through thoughtful diversification.

Start today by reviewing your current investments and identifying gaps.

Consult with financial advisors if needed, but take ownership of your strategy.

Your wealth journey deserves the balance and momentum that the Wealth Wheel provides.

Let this metaphor guide you to a brighter, more secure financial horizon.