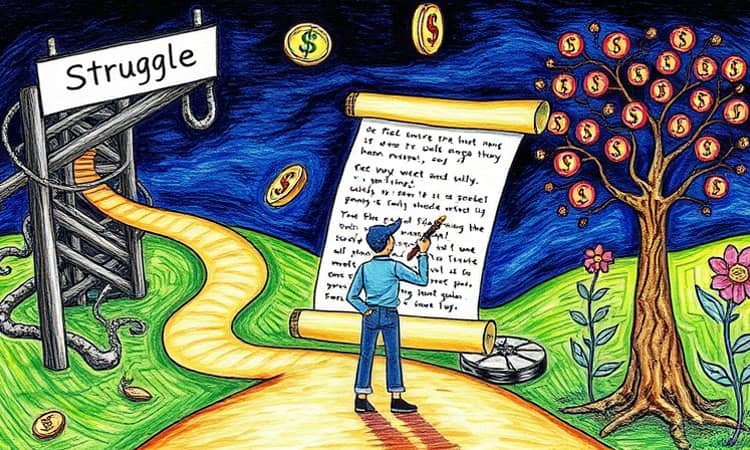

Your financial narrative shapes every money decision you make, often without you realizing it. The stories passed down by caregivers, reinforced by culture, and amplified through advertising form a script that can keep you stuck in scarcity or guide you toward abundance.

Understanding Your Money Story

We all carry a money story—an internal script built from childhood messages like “money doesn’t grow on trees” or “we can’t afford that.” These inherited beliefs influence how we earn, spend, save, and invest.

Our personal experiences of scarcity or abundance—a sudden job loss, an unexpected windfall, or crushing debt—become pivotal chapters that reinforce or challenge those early messages. When left unexamined, this narrative can limit us, making security feel unattainable.

Uncovering Your Current Financial Narrative

Before you can rewrite your story, you must first understand it. These four steps will guide you through an honest self-reflection:

- Identify inherited money messages: Recall phrases you heard growing up. What did caregivers say about bills, loans, or lavish spending?

- Notice your patterns and triggers: Track impulse purchases, feelings when checking bank balances, and career decisions influenced by fear or comfort.

- Link beliefs to behaviors: For example, if you believe “money is hard to come by,” you may avoid negotiating salary or investing in your future.

- Name your current narrative: Label it—“I’m the struggler,” “I’m the spender.” Naming creates distance and empowers change.

Rewriting Your Money Story

Moving from an unconscious, scarcity-centered story to a consciously re-written narrative requires both mindset shifts and aligned actions. Start by defining what security means to you personally.

Ask yourself: In five years, who do I want to be in relation to money? What beliefs would a person who feels confident about money hold? Draft statements such as:

“I am learning to be a good steward of money.”

“Money is a tool that supports my values.”

“I can increase my income and build safety over time.”

These affirmations are not empty words—they serve as anchors for practical habits and systems you’ll implement.

Shifting Beliefs into Skills and Systems

True transformation happens when new beliefs pair with concrete practices. Below is a table illustrating how old narratives can evolve into empowered actions:

Building Financial Security with Concrete Habits

With your new narrative in place, layer in these foundational building blocks. Each one strengthens the story you’re telling yourself about abundance and capability.

Maintaining Momentum and Reinforcing Your New Story

Transformation is a journey, not a destination. Make it a habit to revisit your narrative and habits monthly:

• Reflect on how your beliefs are shifting—have you started to see opportunities instead of obstacles?

• Celebrate small wins—whether it’s a fully funded emergency fund or a successful salary negotiation.

• Adjust your goals and systems as your life evolves, ensuring your story stays aligned with your values.

Conclusion

Reshaping your financial narrative from struggle to security blends mindset work with tangible financial strategies. By uncovering inherited beliefs, crafting a deliberate new story, and building supportive systems, you empower yourself to move confidently toward lasting abundance.

Your money story is in your hands—rewrite it with intention, back it with action, and watch your financial future transform.