Managing money effectively requires more than just tracking totals—it demands precise timing. A cash flow calendar transforms financial data into a visual roadmap, showing exactly when funds arrive and when obligations must be met.

In this comprehensive guide, you will discover how to build, maintain, and leverage a cash flow calendar to prevent unexpected overdraft fees, steer clear of late payments, and strengthen your long-term financial habits.

Introduction to Cash Flow Calendars

A cash flow calendar visually organizes your income and expenses on a day-by-day, week-by-week, or month-by-month basis. Unlike static budgets, it emphasizes timing, helping you see precisely when money enters and leaves your account.

By plotting these events chronologically, you gain crystal-clear insight into cash movements, enabling you to anticipate low-balance days and plan accordingly.

Why You Need a Cash Flow Calendar

Whether you’re managing household finances or overseeing business cash management, a well-maintained calendar provides a strategic edge. You move from reactive scrambling to proactive planning.

- Prevents missed bills and fees by tracking payment due dates and avoiding late charges.

- Highlights spending patterns and leaks, so you can reduce waste and reallocate funds.

- Promotes saving and investing discipline by scheduling “pay yourself first” contributions.

- Accelerates debt repayment effectively through snowball or avalanche methods with extra paychecks.

- Eliminates mid-month cash panic, giving you confidence that funds will be available when needed.

Core Steps to Creating a Cash Flow Calendar

a. Gather Your Financial Data

Begin by compiling every source of income and every expense. Include both regular items—like salaries and mortgage payments—and irregular events such as car repairs or annual subscriptions.

Note the exact dates for paydays and bill due dates. Understanding your pay cycle—weekly, biweekly, semimonthly, or monthly—is crucial for accurate mapping.

b. Choose Your Tool

Select a platform that matches your style and technical comfort. Options range from digital calendars and spreadsheets to budgeting apps and even pen-and-paper journals.

- Google Calendar or Outlook with color-coded entries

- Excel or Google Sheets template with built-in formulas

- Dedicated budgeting apps like YNAB or Cash Flow Calendar

c. Input Data Chronologically

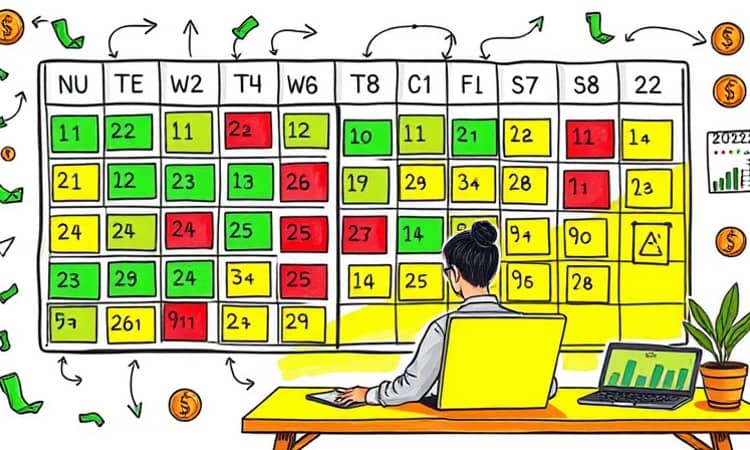

On each date, map inflows and outflows with clear labels. Use color codes: green for income, red for bills, yellow for reminders or low-balance warnings.

This visual distinction allows you to scan your calendar at a glance and identify critical days where multiple payments coincide.

d. Calculate Running Balances

Use a simple formula for each day or week:

Opening Balance + Inflows − Outflows = Closing Balance

By updating this balance continuously, you can spot future shortfalls and take corrective action before an overdraft occurs.

e. Adjust and Reconcile Regularly

At the end of each month, compare projected balances against actual bank statements. Update your calendar to reflect any discrepancies, refine future projections, and establish automated reminders for upcoming obligations.

Pay Cycle Reference Table

Using a Cash Flow Calendar for Advanced Money Management

Once your calendar is in place, it becomes a powerful tool for achieving both short- and long-term goals. You can:

- Spot high-expense days and stagger payments to smooth out cash demands.

- Schedule lump-sum debts around extra paychecks for rapid balance reduction.

- Automate transfers to savings or investments on the exact days you receive income.

- Plan for major purchases by breaking costs into bite-sized, calendar-linked installments.

Visual and Behavioral Tips

Incorporate daily or weekly reviews into your routine, perhaps alongside a morning coffee. Seeing upcoming obligations reduces impulse spending and strengthens your commitment to financial goals.

Color coding and icons—such as dollar signs for income or warning symbols for low-balance days—create a highly engaging and interactive system that builds accountability.

Common Pitfalls and How to Avoid Them

- Ignoring irregular expenses—always include annual fees, gifts, and unexpected repairs.

- Treating bonus pay or “extra” checks as spending money—instead, allocate them to defined goals.

- Skipping monthly reconciliations—this undermines accuracy and trust in your system.

- Forgetting to anticipate seasonal or freelance income variations—plan buffers for low-income periods.

Psychological and Long-Term Benefits

Maintaining a cash flow calendar offers more than improved numbers. It delivers less stress and more confidence by removing the fear of the unknown.

As you witness consistent progress—whether it’s building an emergency fund or paying off debt—you reinforce positive behaviors and cultivate a mindset geared toward lasting financial wellness.

Conclusion

By visually organizing every dollar with a cash flow calendar, you gain clarity, control, and peace of mind. The process guides you from scattered financial data to a structured plan that adapts as life changes.

Take the first step today: gather your data, choose your tool, and map out the next 30 days. With disciplined tracking and periodic reviews, you’ll find that mastering your money is not only possible—it’s empowering.